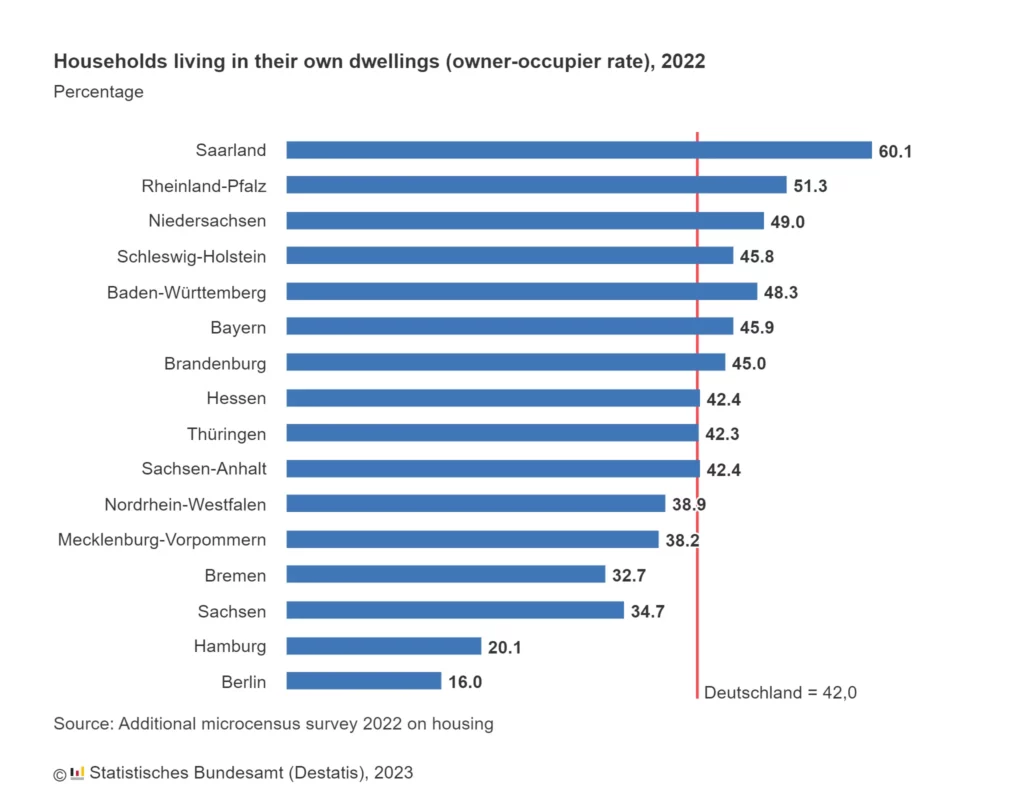

According to Eurostat statistics as of 2022, 53.2% of the German population rented their homes. This is the highest share in the European Union and quite high in general, considering the EU average is 30.9%.

If we take a look at the statistics among the cities, we’ll see that in Berlin and Hamburg, only 16% and 20.1% respectively of the population own their homes, all others are renting.

While there are certain challenges when you rent your home (for example, the risk of rent increase and limited control and customization), rent comes with a lot of benefits as well if done correctly:

- As a renter, you get financial flexibility (because it requires less upfront costs to rent than to purchase a property) which allows you to invest in various other experiences or things.

- As a renter, you get mobility and can relocate more easily, for example, in case you get a lucrative job offer in another part of the city, country, or even the world.

- As a renter, you get lower maintenance responsibility, since those are usually the landlord or managing company’s responsibilities.

Therefore, as a person who is looking for a home to rent, it is important to find a place that:

- Meets the requirements re: affordability (we wrote about the housing affordability crisis in Germany previously)

- Meets the requirements re: location

Those are the two primary things people are looking for, but then you get a wide range of additional benefits or features that make certain properties more or less attractive.

What does this mean for real estate developers and property investors?

Build-to-Rent (BTR) sector’s investment attractiveness

The “build-to-rent” (BTR) sector refers to a model in the real estate industry where purpose-built rental properties are constructed by developers with the intention of renting them out to tenants.

According to the BNP Paribas report, only in Germany, investments amount to € 23bn over the last 5 years. The preferred locations, as one can guess, are large cities where people rely on renting anyway:

- Berlin/Brandenburg metropolis (25% of investments or around € 6bn)

- Frankfurt/Rhine-Main (15% of total investments or around € 3.3bn)

- Hamburg metropolis (nearly € 2bn)

What sets the build-to-rent sector apart from the traditional real estate properties that end up for rent?

- Purposeful Construction for Rental Income:

- In the build-to-rent sector, properties are purposefully designed and constructed for the purpose of renting rather than for sale. Developers aim to create rental communities that offer modern amenities and cater to the needs and preferences of renters. This includes features like communal spaces, fitness centers, coworking areas, and pet-friendly facilities.

- Long-term Investment Strategy:

- Investors in the build-to-rent sector typically adopt a long-term investment strategy, focusing on stable and predictable rental income over an extended period. This contrasts with the traditional real estate model, where the focus is often on property appreciation and eventual sale. Investors seek to build and maintain a portfolio of rental properties to generate a steady stream of rental income.

- Tenant-Centric Approach:

- The build-to-rent sector emphasizes a tenant-centric approach, striving to enhance tenant satisfaction and retention. Property managers and developers prioritize providing excellent customer service, responding promptly to maintenance requests, and fostering a sense of community within the rental developments. Understanding and meeting the needs of the target tenant demographic is crucial for success in this sector.

For real estate developers, this is a great thing because:

- The financing is done in such a way that there is less need for bank financing, whereas it is mostly investors and developers that can do it.

- The assets are standardized. All units have the same design, materials, and quality. In the long run, this is adapted based on experience and feedback, but it all still remains standardized which simplifies maintenance. Because of this simplified relationship (developers + investors) instead of multilateral (developers with several individual buyers), the decision-making process is also easier.

- Less money is spent on marketing by developers. It’s up to the investors to find tenants for each apartment or house, therefore developers can focus on their core thing: building.

- As a result of all three reasons above, there is a fourth advantage of Build-to-Rent over Build-to-Sell for developers and it is being able to build more houses or apartment complexes because they don’t have to worry about finances, different designs, or marketing & sales.

That’s all great. Let’s look at the challenges in this sector in the DACH region.

Build-to-Rent Sector Challenges in Germany, Austria, and Switzerland

- Regulatory Environment:

- In Germany, strict rental regulations safeguard tenants but present challenges for BTR investors in setting profitable rental rates while complying with these regulations.

- Switzerland’s real estate regulatory landscape is intricate, varying across regions, making it challenging for BTR developers to navigate.

- Similarly, Austria has its unique real estate regulations, emphasizing the importance of understanding and adhering to them for successful BTR development.

- Land Availability and Costs:

- Securing suitable land for build-to-rent (BTR) projects in desirable urban locations is a persistent challenge due to limited availability and high costs. This issue is prevalent in Germany, Switzerland, and Austria. In Germany, the acquisition of land comes at a premium price, substantially affecting the financial viability and overall feasibility of BTR developments, especially in city centers.

- Similarly, Switzerland experiences elevated costs for both land and construction, especially in prime urban areas, necessitating a delicate balance between expenses, adherence to stringent building standards, and the goal of providing affordable rental options.

- Austria faces a comparable situation, particularly in major cities like Vienna, where high land prices directly impact the practicality of BTR initiatives. Developers in all three countries must carefully evaluate the local real estate market and construction expenses to make informed decisions regarding the viability of their BTR projects.

- Cultural Preference for Homeownership:

- Promoting long-term renting within purpose-built communities poses a challenge in Germany, where homeownership is deeply ingrained in the culture, and a substantial portion of the population prefers owning their homes. Shifting this mindset towards embracing rental living and emphasizing the advantages of purpose-built communities requires effective education and outreach efforts within the BTR sector.

- Similarly, in Switzerland, the cultural inclination towards homeownership presents a challenge for convincing people of the benefits of long-term renting and purpose-built rental communities. Educational campaigns and strategic marketing efforts are pivotal in altering this preference and fostering a positive perception of rental living.

- Austria shares a similar cultural inclination towards homeownership, reflecting a broader European trend. Convincing Austrians to embrace long-term renting necessitates targeted marketing and education initiatives to demonstrate the benefits and appeal of purpose-built rental accommodations.

- Sustainability and Energy Efficiency Standards:

- Germany, Switzerland, and Austria all prioritize sustainability and energy efficiency when constructing buildings. However, meeting these high standards while keeping costs reasonable is tough for developers in the build-to-rent sector. They need to achieve sustainability certifications without making the housing too expensive for people.

- In Switzerland, sticking to these sustainability rules can cost more, making it challenging to balance with financial feasibility.

- Austria faces similar challenges—while sustainability is a focus, finding cost-effective ways to integrate these features is crucial for build-to-rent projects.

- Tenant Expectations and Preferences:

- In Germany, renters expect rental homes to be of good quality with a nice design and useful facilities. Balancing this with keeping the costs reasonable for build-to-rent projects is not easy. It’s crucial to understand what the renters want for the BTR projects to succeed.

- In Switzerland, renters also want their homes to be high-quality, well-designed, and environmentally friendly. Achieving this while keeping the costs in check is a difficult task for BTR developers. Sustainability is a big deal, but it can cost a lot.

- Austrians, too, have their own preferences in housing like apartment size, having access to outdoor spaces, and being close to public transportation. Making rental homes that fit these preferences and are affordable is a big challenge.

- Financial Considerations and Investment Models:

- Getting enough money to start BTR projects in Germany is hard because investors and banks worry about renting for a long time. It’s essential to show them that BTR projects can make good money and are stable in the long run. BTR projects need a lot of money at the beginning. Convincing investors and banks to give this money is tough because BTR projects last a long time and make money from rent. Making investment plans that match what investors and banks want is very important. It helps to show that BTR projects can be a good investment.

- Market Demand, Competition, and Localization:

- Knowing what people want in terms of where they want to live, what they need, and how they like to live is really important. Making BTR places that fit what the people want while also making enough money is hard. Some places have a lot of people looking for rental homes, but in other places, there’s strong competition between rental homes and homes people can buy. Understanding what’s going on in each area’s rental market is key to making BTR work well.

- Marketing & Property Management

- Once the building is finished and people start living in it, it is important to set up efficient property management. This means making sure people live there and pay rent on time. The management needs to focus on what people need and solve any issues. It also has to make sure the place is good for the environment and add things like nice facilities to make people like living there. And, at the same time, it has to not cost too much to run so that the people who invested in it get good money.

A separate challenge is tenant protection laws in Switzerland, Germany, and Austria.

Germany has well-established and tenant-friendly rental laws. Some key aspects include:

- Rent Control (Mietpreisbremse): Certain areas have rent control laws to limit rent increases, preventing excessive hikes in rental prices.

- Security of Tenure: Tenants generally have strong protection against eviction, and leases are often long-term, providing stability and predictability.

- Maintenance and Repairs: Landlords are responsible for property maintenance and repairs, ensuring that the rented property is habitable and safe.

- Tenant Associations: Germany has active tenant associations that offer legal advice and support to tenants, helping them understand and protect their rights.

Switzerland also has robust tenant protection laws. Some notable features include:

- Rent Regulation: Each canton in Switzerland may have its own rules regarding rent control and rent increases, providing a framework to ensure fair rental pricing.

- Security of Tenure: Tenants have strong legal protection against eviction, and leases often have long notice periods.

- Maintenance and Repairs: Landlords are generally responsible for maintaining the property in good condition and ensuring it’s suitable for living.

- Deposits: Swiss law regulates the amount and handling of rental deposits, aiming to protect tenants’ financial interests.

Austria has tenant-friendly laws aimed at protecting renters’ rights. Key aspects include:

- Rent Regulation: Austrian law provides rules for regulating rents to ensure they are fair and not excessive.

- Security of Tenure: Tenants have strong protections against eviction, and leases often have long-term agreements.

- Maintenance and Repairs: Landlords are obligated to maintain the rented property in good condition, and they must address necessary repairs promptly.

- Tenant Associations: Like in Germany, Austria has active tenant associations that provide legal advice and support to tenants.

Build-to-Rent Sector Similarities & Differences in Germany, Austria, and Switzerland

Similarities in the DACH Region Build-to-Rent Sector:

- High Demand for Rental Housing:

- All three countries experience a relatively high demand for rental housing, driven by factors such as urbanization, migration, a growing young professional demographic, and evolving societal attitudes toward homeownership.

- Sustainability Focus:

- Austria, Switzerland, and Germany emphasize sustainability and energy efficiency in construction and real estate development. These countries often have stringent standards for sustainable building practices to promote environmental responsibility and energy conservation.

- Preference for High-Quality Amenities:

- Tenants in all three countries seek high-quality amenities and features in their rental properties. Modern, well-designed units with amenities like energy-efficient appliances, communal spaces, fitness centers, and smart home technology are often in demand.

- Tenant Protections:

- The three countries have strong tenant protection laws and regulations that outline tenant rights and responsibilities, lease agreements, and dispute resolution processes. These laws aim to maintain a fair and balanced relationship between landlords and tenants.

- Regulatory Complexity:

- The BTR sector in each country faces regulatory complexities related to zoning, construction permits, building codes, and rental laws. Navigating these regulations and compliance requirements is a challenge for developers and investors.

Differences between Germany, Austria, and Switzerland:

- Regulatory Framework:

- The regulatory frameworks governing the BTR sector differ in each country. Germany has specific legislation like the “Mietendeckel” (rental cap) in Berlin, while Austria and Switzerland have their own unique set of rental laws and regulations, often varying by region.

- Cultural Attitudes Toward Homeownership:

- Cultural attitudes toward homeownership vary across these countries. Germany and Switzerland traditionally have strong cultures of homeownership, while in Austria, the rental market has historically been more prominent. This affects the perception and acceptance of BTR developments.

- Land and Construction Costs:

- The costs associated with land acquisition and construction differ in each country. Switzerland tends to have particularly high land and construction costs, followed by Austria and Germany. These cost disparities impact the financial feasibility of BTR projects.

- Availability of Land:

- Land availability varies across the countries, with Switzerland facing significant limitations due to its mountainous terrain and limited developable land. Austria has more available land compared to Switzerland, while Germany, especially in urban areas, faces challenges related to land scarcity.

- Market Dynamics:

- The BTR market dynamics, including demand, supply, and competition, are unique to each country due to differences in population growth, urbanization rates, economic conditions, and cultural preferences. For instance, demand drivers and competitive landscapes can vary significantly.

How to tackle the challenges?

There are numerous ways and schemes of building investment portfolios and establishing partnerships with construction companies, etc. We’ll stop, however, on the part where we are experts: software that can help the challenge we’ve mentioned: managing the property and providing a good living experience for the tenants in the long run.

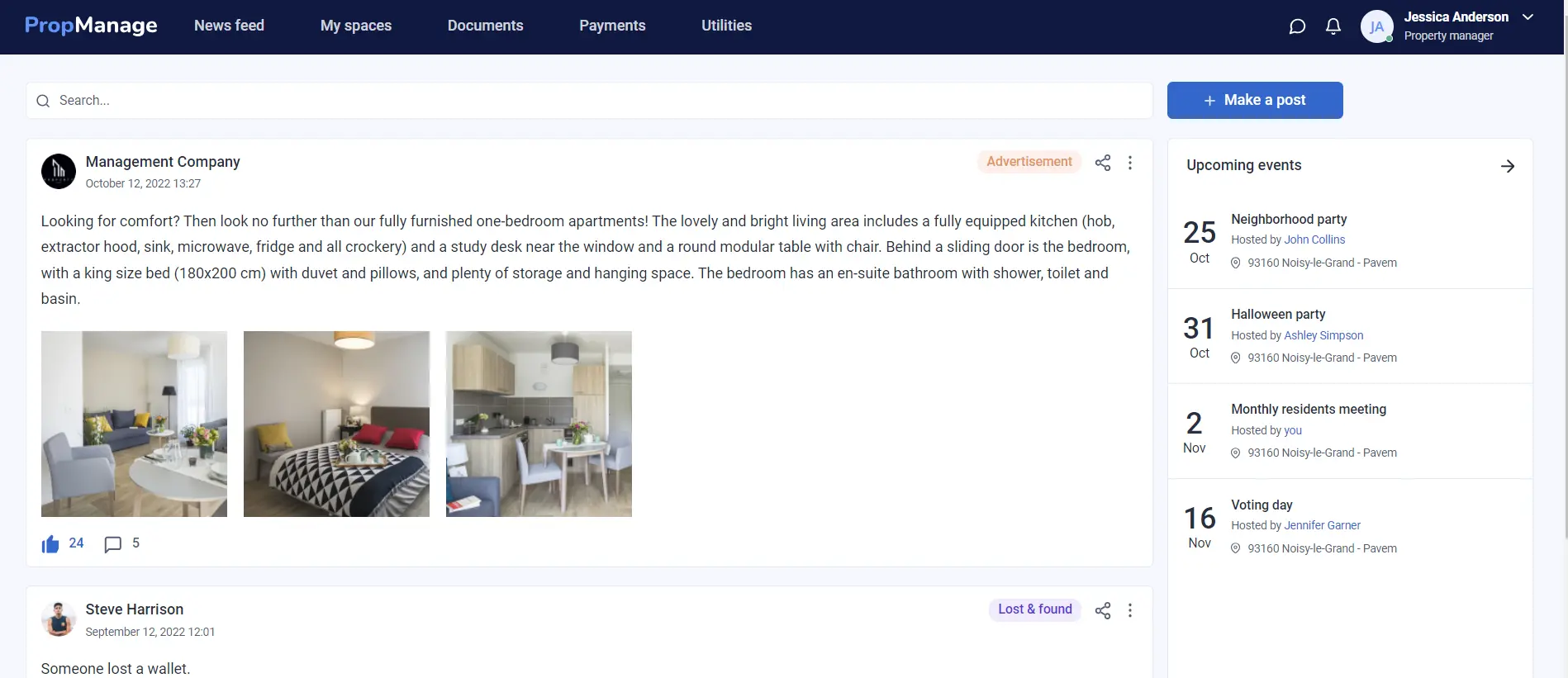

For BTR property managers: property management software

This is a convenient thing in general when you have properties to rent out, but in the Build-to-Rent sector, a good property management solution is critical to success because otherwise it simply won’t be a sustainable business.

What to look for in property management software? Here are 18 features to check:

- User-Friendly Interface: Intuitive and easy-to-navigate interface to facilitate quick adoption and use.

- Property and Tenant Management: Ability to manage property details, including lease terms, rent payments, maintenance history, and tenant information.

- Lease and Contract Management: Track lease agreements, terms, renewals, and other contract-related information.

- Rent Collection and Financial Management: Streamlined rent collection, automated rent reminders, late fee calculation, and financial reporting for better financial oversight.

- Expense Tracking and Budgeting: Tools to track expenses, generate expense reports, and help in budget planning and management.

- Maintenance and Work Order Management: Efficient system for handling maintenance requests, scheduling repairs, and tracking maintenance history.

- Communication and Notifications: Communication features for seamless interaction with tenants, such as automated notifications, email integration, and messaging systems.

- Document Management: Centralized storage and easy access to important documents, contracts, and other property-related files.

- Integration and Compatibility: Ability to integrate with other systems or tools like accounting software, online payment gateways, or tenant screening services.

- Tenant Portals: Online portals for tenants to submit maintenance requests, pay rent, view lease agreements, and access important documents.

- Reporting and Analytics: Comprehensive reporting capabilities to analyze financial performance, occupancy rates, and other key metrics.

- Scalability: Ability to grow and adapt to the changing needs of your property portfolio without requiring a complete software overhaul.

- Automation and Workflow Management: Automation of routine tasks, workflows, and reminders to improve operational efficiency.

- Compliance and Legal Support: Features to help ensure compliance with local housing laws, regulations, and industry standards.

- Customer Support and Training: Access to reliable customer support and training resources to assist in using the software effectively.

- Mobility and Accessibility: Availability of mobile apps or a mobile-friendly interface for on-the-go management and access to information.

- Security and Data Protection: Strong security measures to protect sensitive data and ensure compliance with data privacy regulations.

- Customization and Flexibility: Customizable settings and features to tailor the software to your specific property management processes.

At HUSPI, we’ve got a property management software prototype that can be easily customized and adapted for the requirements of the property.

For tenants: convenient mobile and web apps

Tenant experience matters a lot in build-to-rent properties because happy tenants mean a thriving rental community. Imagine you move into a new apartment, and it’s not just a place to crash, but a place that feels like home. When tenants have a good experience, it means they’re satisfied with where they live, and they’re more likely to stay longer.

Think of it like this: if you go to a restaurant and the food is great, the service is friendly, and the ambiance is lovely, you’d want to go back, right? It’s the same with renting a place. If the building is well-maintained, the landlord or management is responsive and helpful, and there are nice amenities and services, it’s a win-win.

Happy tenants tend to take care of the property, pay rent on time, and even recommend the place to their friends. Plus, a good tenant experience can set a positive reputation for the property, attracting more renters and creating a great community vibe. So, creating a good experience for tenants isn’t just about being nice—it’s smart business too!

At HUSPI, we’ve got several customizable prototypes for this area as well.

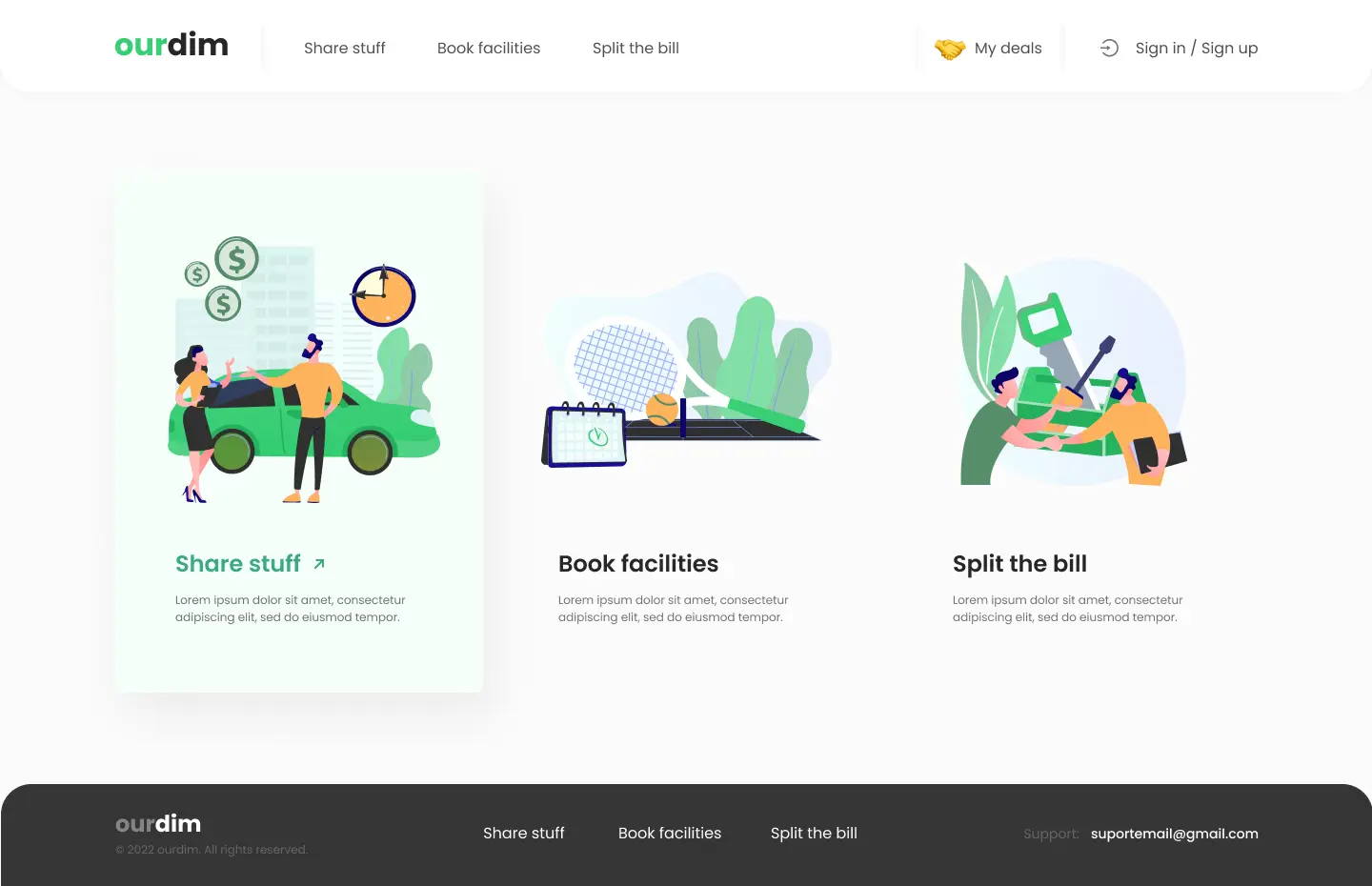

- OurDim Web & Mobile Platform: The sharing economy platform that not only helps your buyers save on unnecessary expenses but also fosters a sense of community, streamlines eco-conscious practices, and provides an expanded array of accessible resources.

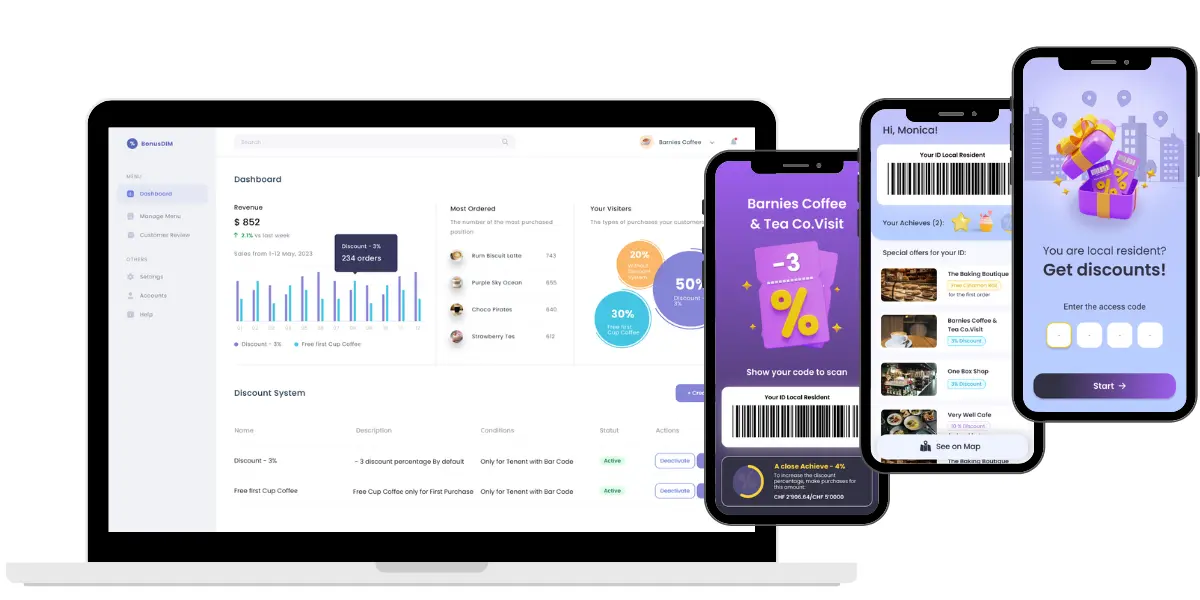

- BonusDim Mobile App & Management Dashboard brings an unparalleled level of value to your tenants. Gone are the days of mundane living arrangements. Now, each resident gains automatic access to a world of exclusive discounts and offers from various local businesses, enriching their day-to-day experiences. Say goodbye to traditional loyalty cards and complicated sign-ups – the app seamlessly integrates into their apartment package.

Conclusion

The Build-to-Rent sector is booming around the world because people value flexibility and being able to live without the hassle of taking care of the home while they are young – or when they are old and simply want to enjoy life.

While homeownership usually is a good strategy in the long run, it is always nice to have options. One build-to-rent community in the United States even has special classes for their tenants to provide the financial skills and knowledge necessary to purchase a property in later life. In the meantime, people get the opportunity to live in a community without any maintenance headaches, while investors and construction companies are solving the issues of affordable housing and long-term profit.

What do you think about the Build-to-Rent initiatives? What are the hidden dangers that we haven’t mentioned? What are the benefits that might be uncovered?

Share your opinion with us and we’ll add it to the article.