Our world requires money and wisdom for financial decisions. While a lot of wisdom comes from experience, there are a lot of benefits that can be gained from technology-based insights.

We’ve talked about open banking in general before and today we’ll focus on the benefits for the clients.

Based on the report prepared by the Open Banking Implementation Entity (OBIE), here are a few insights about the implementation and use of open banking technology for various financial services across the UK:

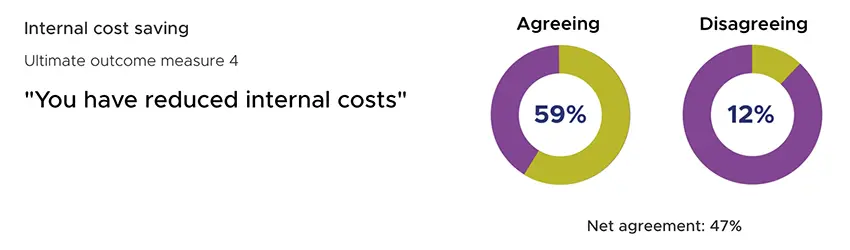

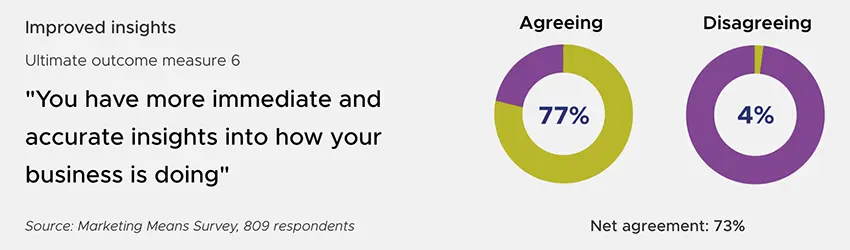

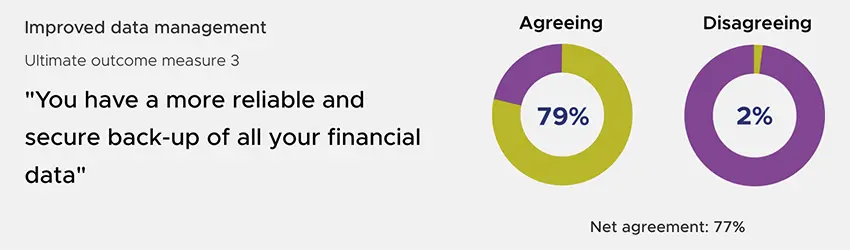

As we see from the infographics, the use of open banking APIs and technologies, in general, helped to:

Open banking is a term that describes the practice of allowing third-party financial service providers to access bank account information and payment initiation services through Application Programming Interfaces (APIs). This allows for the creation of innovative financial products and services that can help consumers better manage their finances.

API integration refers to the process of integrating different software systems through APIs. The use of APIs is a key enabler of open banking. In the context of financial services, API integration allows different financial institutions and service providers to share data and functionality with each other to:

Read our guide to the Open Banking APIs here.

In addition to improving the customer experience, open banking and API integration can also help to promote innovation in the financial sector. By enabling third-party developers to access financial data and services, new and innovative financial products can be developed, which can help to increase competition and provide consumers with more choices.

The existing market as of 2022 remains dominated by propositions addressing:

Read more about integrating online payments into your business here.

Overall, open banking is an important trend in the financial services industry, which is helping to drive innovation and improve the customer experience. As these trends continue to evolve, we can expect to see more innovative financial products and services emerge, which will help to meet the changing needs of consumers in an increasingly digital world.

5 challenges to tackle in open banking

While open banking offers numerous benefits, there are also some potential challenges and concerns that need to be addressed. Some of the potential underwater stones about open banking include:

Overall, while open banking offers many benefits, it is important that these potential challenges and concerns are addressed in order to ensure that open banking is implemented in a responsible and sustainable manner.

5 benefits for open banking clients and businesses

Integrating open banking with the help of API offers a wide range of benefits for both financial institutions and their customers. Some of the key benefits of integrating open banking with API include:

There are similar solutions to open banking that aim to promote greater transparency and competition in the financial services industry.

Open Finance

Open Finance is a broader concept than open banking, which includes the sharing of financial data beyond just banking. This includes other financial services such as

- investments

- pensions

- insurance.

Open Finance aims to give consumers more control over their financial data and enable them to access more personalized financial products and services. For example, a person can set up an automatic transfer of money from a savings account into an investment account. Another example is recurring payments to pay off one’s mortgage for the house.

Open Insurance

Open Insurance is a similar concept to open banking, which aims to promote greater transparency and competition in the insurance industry.

Open Insurance involves the sharing of insurance-related data between insurers and other third-party providers, allowing for the creation of new and innovative insurance products. As a result, according to research by Ernst&Young,

- in-house processes are likely to improve

- the administration would be more cost-efficient

- operating costs would decrease

- innovation would be fostered

- customers empowered

- products & solutions tailored to customers’ needs

Open Data

Open Data initiatives, in general, aim to promote greater transparency and access to data across all industries, including financial services. Open Data aims to make data more accessible to businesses and individuals, allowing for more innovation and competition in the marketplace.

Blockchain-based solutions

Blockchain technology is being explored as a way to promote greater transparency and security in financial transactions. By using blockchain technology, financial institutions can create secure, decentralized systems for managing financial data and transactions.

Wondering about time-to-value?

Request a no-obligation discovery call and receive a preliminary estimate tailored to your KPIs.