In the last decade, we got used to being able to pay online for everything from basic shopping to utilities to food delivery, etc. In the last three years, since the beginning of the global pandemic, being able to do everything online has become even more critical for businesses to stay afloat.

Here are a few online shopping statistics:

- Global E-commerce Boom

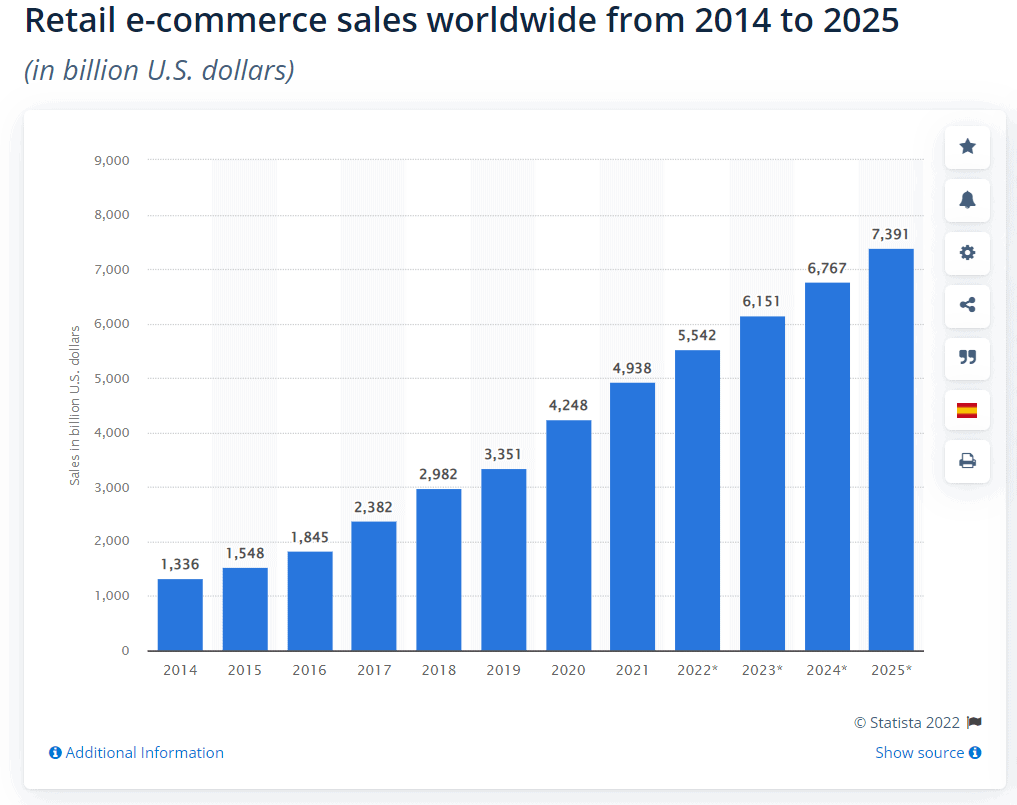

- Market Size: The global e-commerce market is expected to reach a staggering value of over $6.3 trillion by 2024, according to a 2024 report by Statista. (Source: Statista)

- Shopper Growth: The number of online shoppers continues to climb. As of 2024, over 2.64 billion people worldwide are estimated to be active online shoppers. (Source: Statista)

- Shifting Preferences

- Mobile Dominance: Mobile shopping reigns supreme. A 2023 study by Statista suggests that nearly 80% of online retail traffic originates from mobile devices. This highlights the importance of mobile-friendly online stores. (Source: Statista)

- Social Commerce Rise: Social media is increasingly influencing shopping habits. A 2023 report by eMarketer indicates that around 54% of consumers have made purchases directly through social media platforms. (Source: eMarketer)

- Consumer Behavior Insights

- Average Order Value: According to a 2023 report by Statista, the average online shopper spends roughly $189 per visit. This can vary depending on product categories and demographics. (Source: Statista)

- Delivery Preferences: Consumers value convenience. A 2023 study by Digital Commerce 360 suggests that over 60% of online shoppers prioritize fast and reliable delivery options. (Source: Digital Commerce 360)

The COVID-19 pandemic has had a profound impact on the way people shop online. Here are some of the ways online shopping has changed since the pandemic began:

- Increased adoption of online shopping: The pandemic has accelerated the adoption of online shopping, as people have been forced to stay at home and avoid in-person shopping. This has led to a significant increase in the number of people shopping online.

- Shift towards essential items: Initially, there was a surge in demand for essential items such as groceries, household goods, and health supplies. Online grocery shopping and delivery services have seen a significant increase in demand.

- Changes in delivery services: The pandemic has also affected delivery services, leading to delays and changes in delivery policies. Many retailers have also introduced contactless delivery options to reduce the risk of transmission.

- Rise of e-commerce platforms: The pandemic has also led to a rise in the popularity of e-commerce platforms like Amazon, as well as smaller, niche online retailers. As a result, the number of online payment integrations has risen as well.

- Focus on online experiences: With the shift to online shopping, retailers have had to focus on improving the online shopping experience for their customers, including making their websites more user-friendly, offering virtual shopping options, and improving customer service.

Many e-commerce platforms can be used out of the box to create an online shopping experience. However, there are also times when the standard tools don’t do exactly what you need because you might have different payment models, bonuses, or other factors. This is where you get the need for a customized online payment checkout process.

In this article, we’ll talk about the steps for building a payment checkout. As a result, you’ll be able to do this on your own or hire developers to do it for you (but you’ll know what you need to provide so it’s no longer a blind process.)

How to build a payment checkout

Step 1: Choose the gateway

There are numerous payment gateways available on the market. Examples include such well-known services as PayPal, Stripe, and Square. Technically, you can develop your own, but that’s a lot of hassle and quite expensive. Also, these products have been on the market for a long time therefore many of the issues are taken care of.

Step 2: Integrate with the gateway

Integrate the chosen payment gateway into your website or application. This will typically involve creating an account with the gateway and using their API to process transactions.

Most of the payment gateways have exhaustive manuals on how to do the integration. For example, here are PayPal’s instructions [LINK].

Step 3: Create the checkout form

Create the checkout form or page where customers will enter their payment information. This should include fields for the customer’s name, credit card number, expiration date, and CVV code.

Step 4: Ensure security

Since you’re processing the sensitive financial data of your customers, you need to implement security measures to protect customer data, such as SSL encryption and PCI compliance.

It is important to note that there are legal and regulatory requirements for handling and processing payments, so make sure to comply with the laws of your country. It would be good to add GDPR compliance, for example, since the probability of someone coming over to your website from one of the countries covered by this regulation is quite high. (Better be safe than sorry, right?)

Step 5: Test the checkout

Before you launch your online store or service, test the checkout process to ensure that it is working correctly and that all transactions are being processed properly.

Step 6: Analyze the performance

Finally, you can use analytics to monitor your checkout page performance and customer behavior and track any errors or issues. We’ll stop a bit more on this topic below.

How to track conversion on online payments in Google Analytics or other tools?

Various instruments are available to track payment conversions on your website or mobile app. Some e-commerce platforms offer tools and many offer integration with Google Analytics since that’s one of the most widespread options.

While Universal Analytics relied on conversion goals, GA4 utilizes a more flexible approach centered around events. Here’s how to track successful online payments in GA4:

1. Define the Conversion Event:

- Identify the specific user action signifying a successful payment. This could be a “purchase complete” event, “order confirmation” event, or a custom event tailored to your checkout process.

2. Set Up Event Tracking:

- Within your GA4 property, navigate to the “Events” section under the “Engagement” tab.

- If the desired event already exists (e.g., “purchase complete”), locate it in the event list.

- If a custom event is needed, click on “Create event” and define the event parameters (name, type, etc.).

3. Mark the Event as a Conversion (Optional):

- While not mandatory, GA4 allows marking specific events as conversions. This adds further weight to their significance within your reports.

- In the event details, locate the “Conversion Event” toggle and switch it on.

4. Analyze Conversion Data:

- Once transactions are recorded as events, you can explore conversion data in various GA4 reports.

- The “Engagement” section offers reports like “Conversions” and “Conversion Path” to analyze conversion rates, conversion values (if defined), and user journeys leading to successful payments.

Additional Considerations:

- Event Parameters: Utilize event parameters to capture details like purchase amount, product information, and customer data for more granular analysis.

- Enhanced E-commerce (Optional): Consider implementing Enhanced E-commerce for even richer data on purchase behavior, including product details, shipping costs, and taxes.

Benefits:

- Flexibility: GA4’s event-based approach allows tracking various payment scenarios beyond “Thank You” pages.

- Detailed Insights: Event parameters unlock deeper analysis of user actions and purchase details.

- Future-Proof: GA4’s focus on events aligns with the evolving data landscape and adapts to changing customer behavior.

Additionally, you can track conversion using other tools like:

- Meta Pixel: add a code snippet to the “Thank you” page after the successful transaction.

- Google Tag Manager: set up tags and triggers to track conversion events on your website.

- Mixpanel: track events on your website and analyze the data to identify conversion funnels and track conversion rates.

- Heap: set up automatic capture of all user interactions on your website and track conversion by creating custom events and metrics.

- Hotjar: track conversion rates by creating heatmaps and recording user sessions to analyze user behavior and identify areas of improvement.

What are the most frequent errors with online payments in e-commerce?

Several common errors can occur with online payments in e-commerce:

Payment declined

Oh, snap! The credit card information was declined. Please check the information provided and contact your bank if necessary.

Payment Declined

This can happen due to a variety of reasons, such as incorrect payment information, insufficient funds, or a fraud alert from the customer’s bank.

Payment failed

Paypal is not able to process this order. Please contact the retailer for more information.

Gateway Error

This can occur if there is an issue with the payment gateway, such as a problem with the API or server downtime.

Invalid payment method

Your payment method was declined. Please enter valid payment method information.

Invalid Payment Method

This can occur if the customer attempts to use a payment method that is not accepted by the merchant, such as an expired credit card.

Your request couldn’t be processed at this time.

If you encounter this message more than once, please contact us and we’ll do our best to help.

Error code: 70005

Cart Error

This can occur if there is a problem with the customer’s shopping cart, such as items being out of stock or the wrong price being displayed.

Address information required

The shipping address provided is either incorrect or incomplete. Please update the information to receive information on shipping dates and costs.

Incorrect Address

This can occur if the customer enters the wrong billing or shipping address, which can cause issues with fraud detection and order fulfillment.

The secured browser could not be started

You may proceed at your own risk, but we could not launch the secured browser to ensure additional protection for your credit card numbers, banking transactions, and other sensitive data.

Associated error code: 0x84769d7

Security Error

This can occur if there is an issue with the website’s security, such as a lack of SSL encryption or PCI compliance, which can cause customers to be hesitant to enter their payment information.

A technical issue occurred.

There is a technical issue at your bank. Please try again after some time. Sorry for the inconvenience.

Technical issues

This can occur if there is an issue with the website’s code, a problem with the hosting provider, or other technical problems that can cause the payments to fail.

Your cart has been modified

Your cart has been modified since the last time you accessed it. Therefore, the shipping rate you previously selected no longer applies. Please review your cart.

Abandoned Cart

This can occur if a customer adds items to their cart but does not complete the checkout process, which can be due to a variety of reasons such as shipping costs, taxes, or any other unexpected cost.

By identifying and addressing these errors, you can improve the customer experience and increase the chances of successful transactions.

What are the challenges of integrating online payments on your website?

Integrating online payments on a website can come with a number of challenges, such as:

- Security: Ensuring that customer payment information is kept secure and in compliance with industry standards, such as PCI-DSS, is crucial and may require additional resources and expertise.

- Compliance: Complying with various laws and regulations related to online payments, such as the GDPR, can be complex and time-consuming and may require legal expertise.

- Integration: Integrating a payment gateway with your website can require technical expertise and may involve dealing with different APIs and integration methods.

- Scalability: As the number of transactions increases, the payment infrastructure must be able to handle the increased volume and traffic without any interruption.

- User Experience: Creating a seamless and user-friendly checkout process that maximizes conversion rates can be challenging and require testing and optimization.

- Fraud detection: With the increasing number of frauds, it is important to implement fraud detection systems to prevent unauthorized or fraudulent transactions, which requires a lot of effort and resources.

- Reliability: Ensuring that your payment system is always available and reliable, especially during peak shopping, can be challenging.

- Costs: Implementing and maintaining an online payment system can be costly, including costs for payment gateway fees, PCI compliance, fraud detection, and chargebacks.

By understanding and addressing these challenges, businesses can ensure that their online payment system is secure, compliant, and user-friendly, which can increase customer trust and ultimately drive more sales.

Custom or standard platform for online payments?

Is it better to create your e-commerce platform or use a standard tool for online payments?

Whether to create your e-commerce platform or use a standard tool depends on the specific needs of your business and the resources available to you.

Building your e-commerce platform can give you complete control over the design and functionality of your website, as well as the ability to tailor the platform to the unique needs of your business. However, this can also be a significant investment in terms of time and money, as it will require a team of developers, designers, and project managers, and a significant budget to develop, test and maintain.

Using a standard tool, such as a pre-built e-commerce platform, can save time and money as it typically involves less development work and often comes with built-in features and functionalities. These platforms are also often more cost-effective, and with less maintenance cost. They also often come with pre-built integrations with popular payment gateways and shipping providers, as well as built-in analytics and reporting tools.

However, using a standard tool may also come with some limitations in terms of customization, and may not offer the same level of control and flexibility as building your platform. It’s important to evaluate your business needs, budget, and resources before making a decision.

- If you need to launch your e-commerce platform quickly, and you don’t have the resources to build your platform, then using a standard tool would be a better option.

- If you have the resources and you want a fully customized e-commerce platform that is tailored to your business, then building your platform might be the better option.

Wondering about time-to-value?

Request a no-obligation discovery call and receive a preliminary estimate tailored to your KPIs.