Gone are the days of long lines at the bank and complex financial products. Fintech has ushered in an era of efficiency, accessibility, and user-friendliness. From mobile payments to cryptocurrency, fintech innovations are making financial services more convenient and affordable.

This shift away from traditional payment methods is driving innovation and economic growth on a global scale. As fintech continues to evolve, we can expect even more exciting developments that will further transform the way we manage our finances.

In this article, we’ll look at several FinTech trends that have been the focus of the talks at the Dubai FinTech conference recently in September 2024.

Biometric Payments: The Future of Authentication

Biometric technology has been used for identification for centuries, but its modern application in technology dates back to the late 20th century. Here’s a brief timeline:

Fingerprints were used for identification in ancient Babylon and China.

Advances in photography and technology led to the use of fingerprints for criminal identification.

Biometrics, including fingerprints, facial recognition, and iris scanning, began to be used in various applications, such as access control and law enforcement.

Biometric technology has become more widespread and accessible, with applications in smartphones, passports, and payment systems.

In recent years, biometric technology has experienced significant advancements, with increased accuracy, speed, and affordability. This has led to its growing popularity in various industries, including finance, healthcare, and law enforcement.

Biometric payments, which use unique physical characteristics like facial or hand recognition to authenticate transactions, are rapidly gaining traction. This technology offers a more secure, convenient, and seamless payment experience compared to traditional methods like passwords or PINs.

What are the benefits of biometric authentication?

- Enhanced Security: Biometric data is uniquely yours, making it nearly impossible for anyone to fake or steal. Imagine a world where fraud and identity theft are minimized under the weight of impregnable security.

- Increased Convenience: Remembering passwords (with the increasing number of services that require logging in) is not easy and cards are getting outdated. With biometric payments, a mere touch or glance is all you need to seal the deal.

- Improved User Experience: Biometric authentication provides a more intuitive and seamless payment experience, leading to greater customer satisfaction.

Successful Examples of Biometric Payment Adoption

Over recent years, biometric payment methods have gained significant traction across various sectors.

Examples include Apple’s Face ID and Touch ID, which have revolutionized how users authenticate transactions on their devices. Similarly, Mastercard’s Identity Check Mobile, often referred to as ‘selfie pay,’ has allowed users to authenticate online purchases with facial recognition, increasing both convenience and security.

Retailers like Amazon have also experimented with palm recognition technology in stores, aiming to enhance the shopping experience by making payments faster and more secure. These advancements highlight the potential of biometric payments to transform the financial landscape, offering an innovative blend of convenience and security for consumers around the globe.

- Apple Pay and Google Pay: These mobile payment platforms have popularized facial and fingerprint recognition for in-app and in-store payments.

- Amazon Pay: Amazon’s payment service uses facial recognition for secure and convenient online shopping.

- Biometric ATMs: ATMs equipped with fingerprint or facial recognition technology are becoming increasingly common in many countries.

Dangers of Biometric Payments

While biometric payments offer enhanced security and convenience, they are not without risks. Here are some potential dangers to consider:

- Data Breaches: If biometric data is compromised in a data breach, it can be difficult to change or revoke. This makes it a valuable target for hackers.

- Privacy Concerns: Some individuals may have concerns about the collection and storage of their biometric data, especially in light of potential government surveillance or misuse.

- Technical Limitations: Biometric systems may not be 100% accurate, especially in challenging conditions or for certain individuals. False positives or negatives can lead to inconvenience or security risks.

- Government Surveillance: There are concerns that governments might use biometric data for mass surveillance or tracking purposes. Some countries like China and India have integrated biometric identification into their national payment systems, enabling seamless and secure transactions for millions of users. (Granted, when it’s done at the government level, bureaucracy is a danger to privacy and there should be double or even triple prevention measures to provide that protection.)

To mitigate these risks, it’s important to:

- Choose reputable providers: Select biometric payment systems from trusted companies with strong security measures.

- Be aware of your rights: Understand your data privacy rights and how your biometric data is being used.

- Stay informed about security best practices: Keep up-to-date on the latest security threats and best practices for protecting your biometric data.

Payment Flexibility: More Than Just Cards

As mentioned above, cards are getting outdated. FinTech companies and banks are trying to come up with alternative methods.

Mobile Wallets: Apps like Apple Pay, Google Pay, and Samsung Pay have made it easy to store credit and debit card information on your smartphone. With a simple tap, you can make payments at physical stores and online. Mobile wallets also offer added security features like fingerprint or facial recognition authentication.

Buy Now, Pay Later (BNPL): BNPL services allow customers to make purchases and pay for them over time, often with interest-free installments. This can be a convenient option for managing larger purchases, but it’s essential to use BNPL responsibly and avoid overspending.

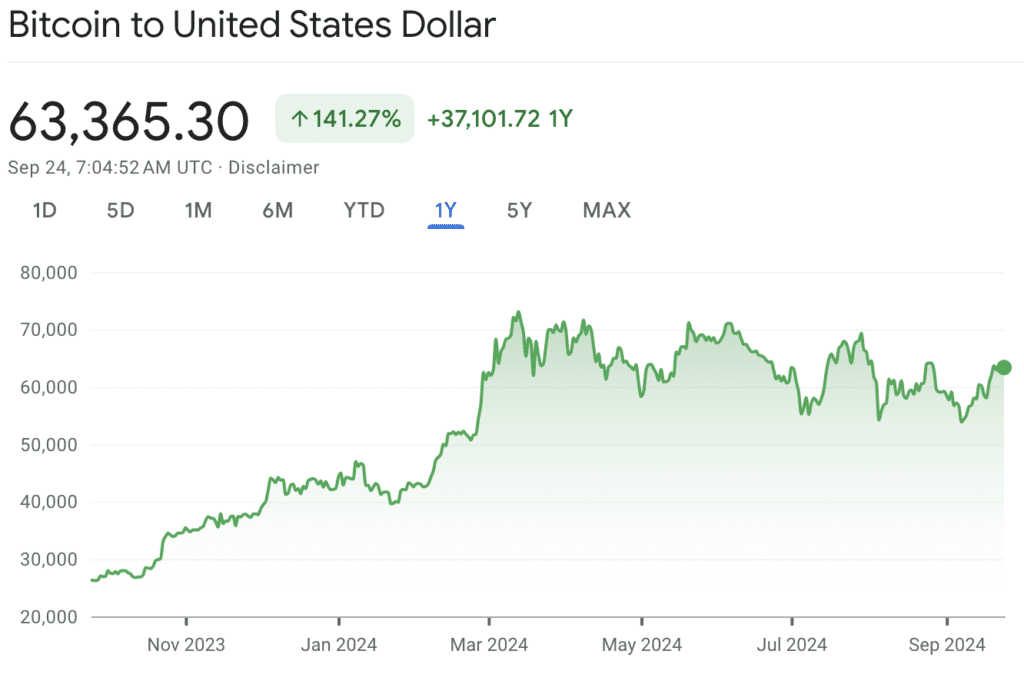

Cryptocurrencies: Digital currencies like Bitcoin, Ethereum, and Litecoin have gained popularity as alternative payment methods. While cryptocurrencies offer decentralized and secure transactions, they can also be volatile and subject to market fluctuations. (We worked with one cryptocurrency and NFT project and it was quite enlightening for our team.)

The Impact of Alternative Payments

The rise of alternative payment methods is revolutionizing the way we shop and conduct business. Consumers are eagerly embracing more flexible and convenient payment options, prompting businesses to enhance their offerings. Moreover, these positive trends are fueling innovation in the financial technology (fintech) sector, yielding exciting new products and services that cater perfectly to evolving consumer needs.

While alternative payment methods offer many benefits, it’s important to consider the potential challenges and risks associated with each option. For example,

- mobile wallets may require specific devices or apps,

- BNPL services can lead to debt accumulation if not used responsibly, and

- cryptocurrencies are subject to market volatility.

Knowing the pros and cons of different payment methods helps people make better choices and lets businesses provide a more well-rounded and awesome customer experience.

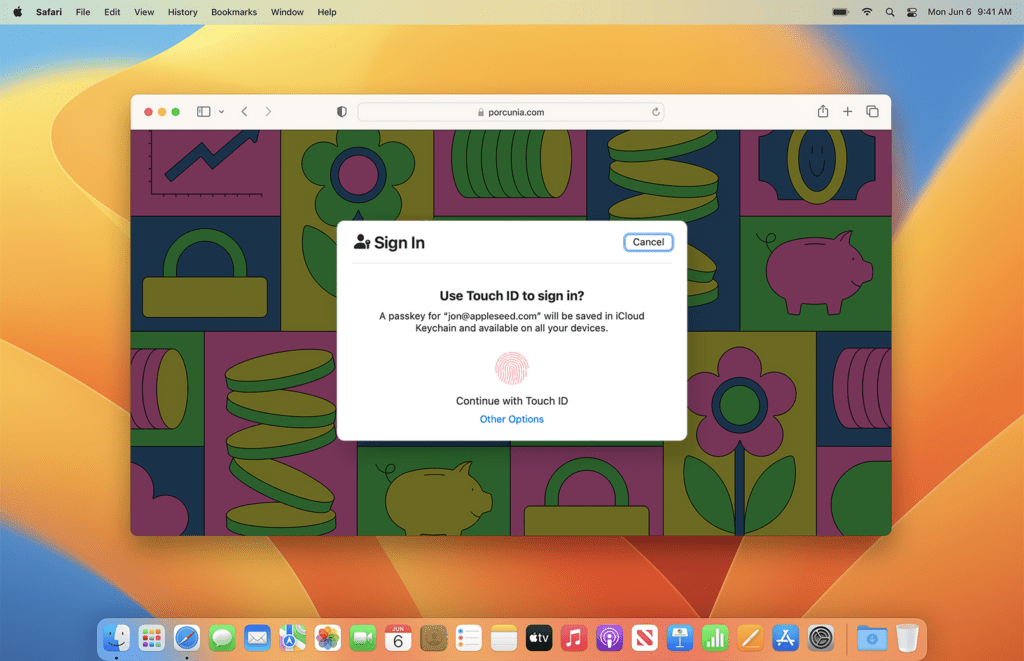

Passkeys: A New Era of Passwordless Authentication

Passkeys are a revolutionary new authentication method that eliminates the need for traditional passwords. Instead of relying on easily forgotten and vulnerable passwords, passkeys utilize biometric data (like fingerprints or facial recognition) or security keys to verify a user’s identity.

How Passkeys Work:

- Device Enrollment: Users enroll their devices (e.g., smartphones, laptops) with a trusted service provider.

- Key Generation: A unique cryptographic key is generated and stored securely on the user’s device.

- Authentication: When a user wants to log in, they simply use their enrolled device. The device verifies their identity using biometrics or a security key, and the passkey is used to authenticate the user.

Security Benefits of Passkeys

Passkeys, following FIDO Alliance and W3C standards, replace passwords with cryptographic key pairs, bringing a powerful boost to security.

- Strong credentials. Every passkey is a fortress. They’re never guessable, never reused, and certainly never weak.

- Safe from server leaks. Servers keep only public keys, making them less attractive targets for hackers.

- Safe from phishing. Passkeys are intrinsically linked with the app or website they were created for, ensuring that you can always confidently use your passkey without the worry of being tricked by fraudulent apps or websites.

- Improved User Experience: Passkeys transform the login process into an effortless experience, removing the need to remember complicated passwords.

The Potential Impact of Passkeys:

Passkeys are poised to revolutionize online authentication, making it more secure, convenient, and user-friendly than ever before. As the adoption of passkeys continues to rise, we can look forward to a notable decline in password-related breaches and a remarkable enhancement in the overall security of online services.

In conclusion, passkeys represent a major step forward in authentication technology. By eliminating the need for passwords, they offer enhanced security, improved user experience, and a more streamlined login process. As passkeys become more widely adopted, we can expect to see a significant reduction in the risk of data breaches and identity theft.

Fast Identity Online: Streamlining the Registration Process

Technologies for Fast Identity Online:

- One-Time Passwords (OTPs): OTPs are generated dynamically and sent to the user’s email or phone number, adding an extra layer of security to the registration process.

- Social Logins: Allow users to sign up or log in using their existing social media accounts, streamlining the registration process and providing pre-filled user information.

- Biometric Authentication: Using fingerprint or facial recognition can provide a convenient and secure way for users to authenticate their identity.

Benefits of Fast Identity Online:

- Improved User Experience: Streamlined registration processes reduce friction and make it easier for users to sign up for your services.

- Increased Conversions: A faster and more convenient registration process can lead to higher conversion rates and increased customer acquisition.

- Enhanced Security: Many fast identity online solutions offer stronger security measures compared to traditional password-based authentication.

- Reduced Support Costs: Streamlined registration can reduce the number of support inquiries related to password resets and account recovery.

Challenges and Considerations:

- Data Privacy: Ensure that you comply with data privacy regulations and handle user data securely.

- User Experience: Carefully design the registration process to be intuitive and user-friendly.

- Integration: Integrating fast identity online solutions with your existing systems may require technical expertise.

By implementing fast identity online solutions, businesses can create a more positive user experience, improve customer acquisition, and enhance their overall security posture.

Key FinTech Trends: Conclusion

First, there was bartering. Then cash became the go-to payment, then cards, and now we’re going beyond anything additional things to just being ourselves to pay for things we need to get. The evolution reflects our ever-changing society, with digital wallets and cryptocurrencies marking the latest advancements. As technology continues to progress, our methods of transaction will undoubtedly become even more seamless, integrating further into our daily lives. From facial recognition to biometric scans, the future of payments appears to be both exciting and challenging, offering unprecedented convenience while also raising new questions about privacy and security.

- Biometric Payments: Facial and hand recognition are becoming increasingly popular for secure and convenient payments.

- Payment Flexibility: Alternative payment methods like mobile wallets, BNPL, and cryptocurrencies are gaining traction.

- Passkeys: Passwordless authentication is emerging as a more secure and user-friendly alternative to traditional passwords.

- Fast Identity Online: Streamlined registration processes are improving the user experience and reducing friction.

The Impact on the Future of Finance:

These trends are poised to have a profound impact on the future of finance. We can expect to see:

- Increased security: Biometric payments and passkeys will reduce the risk of fraud and identity theft.

- Enhanced convenience: Faster and more seamless payment experiences will improve customer satisfaction.

- Financial inclusion: Alternative payment methods can make financial services more accessible to underserved populations.

- Innovation and competition: The fintech revolution will drive innovation and competition in the financial services industry.

Staying ahead of the curve means embracing the exciting world of fintech with enthusiasm. By keeping up with industry news, attending conferences, and exploring emerging technologies, you can gain a deeper understanding of the bright future of finance. Embracing these trends opens up a world of opportunities, allowing businesses and consumers to benefit from the revolutionary innovations that fintech has to offer.

Get a project estimate

Need a quote for a similar project? We specialize in building custom software solutions. Leave your contact information and get your free estimate today!