In 2025, AI in drug development crossed an inflection point. For years, we’ve heard bold promises of “AI-designed drugs,” yet most remained in preclinical hype. That changed this year:

- The FDA released formal guidance on using AI in regulatory submissions, introducing a risk-based credibility framework for models.

- The first generative-AI drug candidate, rentosertib, entered Phase 2 trials for idiopathic pulmonary fibrosis (IPF) with encouraging early results.

- Large pharma companies began opening their industrial-grade AI platforms to external partners.

The result? Faster protocols, smarter recruitment, and a path to reduce time-to-signal without compromising safety. Analysts expect the AI-in-drug-discovery market to grow from ~$2.6B in 2025 to $8–20B by 2030, a CAGR of roughly 26–31%.

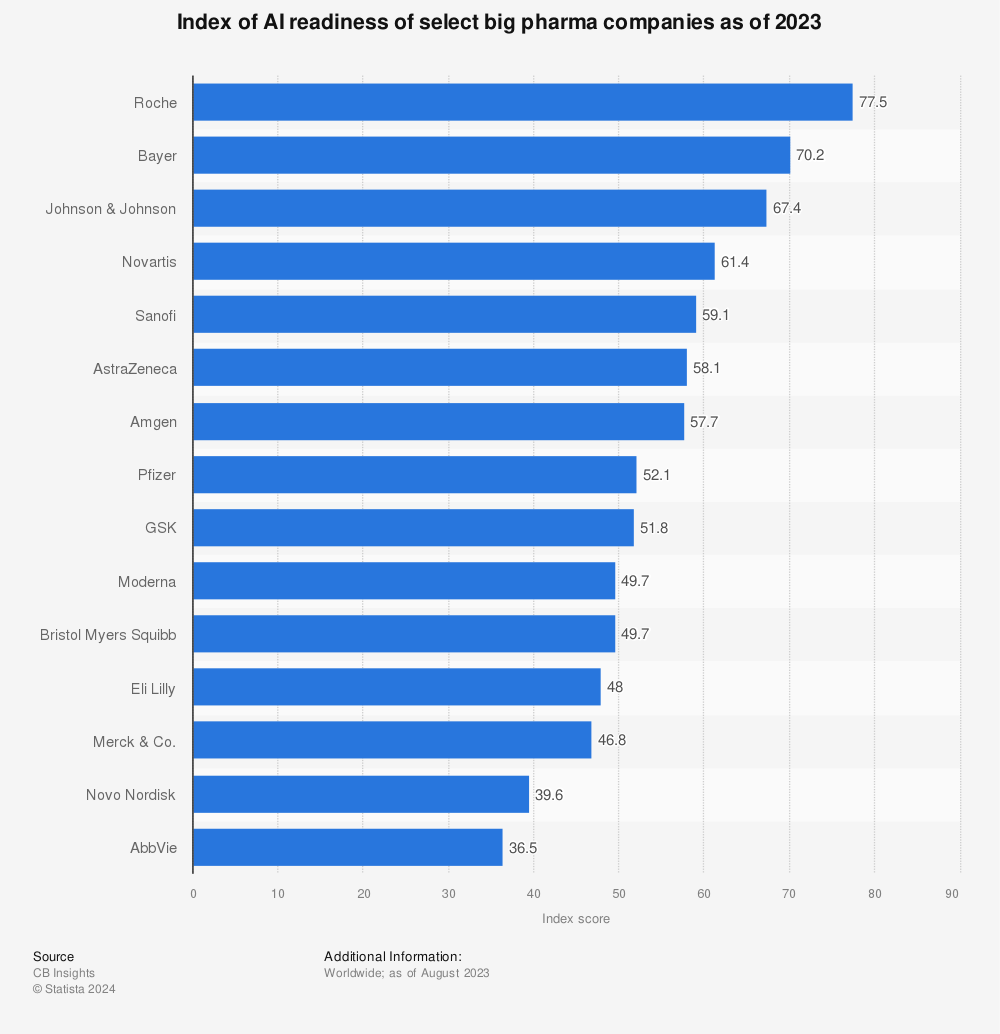

Big pharma was ready for AI even a few years ago – and now, with FDA guidance, this process will take off.

Find more statistics at Statista

AI will not replace discovery teams. But discovery teams using AI will outpace those who don’t.

Let’s take a look at 10 trends that pharmaceutical companies, as well as those that develop various AI products, should take into account.

Trend 1: Foundation Models for Biology & Chemistry Go Collaborative

Why it matters

While there are a lot of ownership rights and other factors involved, collaboration and knowledge sharing help to work at an even faster speed.

Shared model pretraining on structural biology data is dramatically improving protein–ligand interaction prediction, compressing design–test cycles.

What’s happening now

A new pharma consortium (BMS, AstraZeneca, Takeda, J&J, AbbVie, Astex, and more) is pooling proprietary protein–small-molecule structures to train an advanced OpenFold-style model using federated learning infrastructure.

No raw data is exchanged; instead, models update locally and share gradients securely.

Impact

While there are a lot of ownership rights and other factors involved, collaboration and knowledge sharing help to work at an even faster speed.

Shared model pretraining on structural biology data is dramatically improving protein–ligand interaction prediction, compressing design–test cycles.

Trend 2: From “AI-Assisted” to AI-Designed Molecules in Phase 2

Why it matters

Crossing the clinical boundary validates AI’s role beyond hit-finding into clinically meaningful efficacy and safety.

Case in Point

Insilico Medicine’s rentosertib (ex-ISM001-055) was identified by generative AI as a novel TNIK inhibitor for IPF.

In 2025, Phase 2a results showed safety, tolerability, and promising efficacy signals in lung function.

Impact

This is the first generative-AI-designed drug with mid-stage clinical readouts, giving credibility to the entire field.

Expect investors and regulators to take AI-discovered assets more seriously.

Trend 3: Consolidation of AI Discovery Players

Why it matters

The fragmented AI drug discovery landscape is maturing into platform consolidation, allowing larger datasets, stronger pipelines, and more robust commercial pathways.

Case in Point

Recursion Pharmaceuticals announced the acquisition of Exscientia in 2024, expected to close in 2025. This combines two leading AI-native pipelines and brings complementary discovery tech stacks under one roof.

Impact

Smaller startups may shift toward data partnerships or niche specialization, while larger players create “one-stop AI discovery platforms.”

Trend 4: Regulators Are Normalizing AI in Submission

Why it matters

Clearer rules reduce adoption risk and help teams plan validation from day one.

What’s new

- In January 2025, the FDA published its first AI in Drug Development guidance, introducing a risk-based credibility assessment framework for sponsors.

- CDER reports a rising number of submissions citing AI across drug lifecycles.

- The FDA itself is deploying AI internally to streamline review processes.

Impact

AI is no longer “experimental”—it’s becoming an accepted tool within regulated workflows. The compliance bar is higher, but so is confidence.

Trend 5: Generative AI for Protocol Design & “Intelligent” Clinical Trials

Why it matters

Clinical trial protocols are expensive to amend and prone to design errors that waste time and resources.

Now possible

GenAI tools can mine past protocols, real-world data, and regulatory precedents to create optimized study designs with fewer amendments.

Impact

“Intelligent trials” will cut recruitment delays and failure risks, making trials leaner and more adaptive.

Trend 6: Real World Date (RWD) 2.0 – External Control Arms (ECAs)

Why it matters

Recruiting control groups is costly, slow, and ethically challenging, especially in rare diseases.

Case in Point

By analyzing massive amounts of real-world data (RWD), sponsors can build external control arms that regulators are starting to accept as valid comparators.

Impact

Smaller patient cohorts, faster approvals, and lower costs. In rare diseases, this is game-changing.

Trend 7: Federated Learning & Privacy-Preserving Collaboration

Why it matters

Data is pharma’s crown jewel. No company wants to give away proprietary patient or assay data.

Now in use

Platforms like Apheris enable federated learning: pharma companies train models locally and share only model updates, not raw data.

Impact

This allows “collaboration without compromise”—unlocking insights across pharma boundaries while preserving IP and privacy.

Trend 8: Platformization – Big Pharma Opens AI Stacks

Why it matters

Instead of keeping AI pipelines closed, pharma is monetizing them as platform-as-a-service offerings.

Example

In 2025, Eli Lilly launched TuneLab, opening access to AI models trained on billions of R&D data points. Early partners include Insitro and Circle Pharma.

Impact

This advancement democratizes access to industrial-grade AI, lowering the entry barrier for biotechs and academia.

Trend 9: Market Momentum With Steep Growth

The numbers

- $2.6B in 2025 → $8.2B by 2030 (CAGR ~26%)

- Other forecasts: $1.7B in 2024 → $20B by 2030 (CAGR ~31%)

Impact

Regardless of which estimate proves more accurate, the direction is clear: AI is becoming one of the fastest-growing verticals in pharma.

Trend 10: Beyond Oncology – Fibrosis & Immunology Rising

Why it matters

Oncology dominates AI pipelines because it’s data-rich and high-ROI. But new frontiers are opening.

Examples

- Insilico’s IPF program (fibrosis).

- Exscientia’s inflammatory disease pipeline.

Impact

Expect expansion beyond cancer into fibrosis, immunology, and neurodegeneration as AI platforms validate their models across complex disease areas.

AI Playbook for Sponsors & Biotechs

Here are five practical moves to turn AI into measurable impact across discovery and clinical development:

Bake in validation from day one

Define model purpose, datasets, and assumptions. Stress-test edge cases and keep audit trails so your AI meets risk-based credibility expectations.

Get data-ready early

Harmonize sources, adopt FAIR principles, and map data needs for both R&D and regulatory use to avoid downstream delays.

Collaborate without sharing raw data

Use federated learning and secure platform APIs to train across partners while protecting IP and patient privacy.

Start with trials for fastest ROI

Apply GenAI to protocol design, optimize feasibility and site selection, and leverage RWD for external control arms.

Decide buy / partner / build

Build what’s core to your differentiation, partner for speed on the rest, and beware long-term vendor lock-in costs.

* Pro tip: align each step with an owner, KPI, and timeline to turn strategy into execution.

Risks & Reality Checks for AI

All seems to be incredibly nice and wonderful, but we need to remember that artificial intelligence is not a magic wand that can fix everything.

Therefore, there are still risks involved, and reality checks are necessary.

The models can be biased unless validated on diverse datasets. AI bias is one of the most critical problems, and this is even more exacerbated in the case of rare diseases. With those patients and data, researchers need to avoid overfitting in small indications and need to establish careful statistical safeguards.

Vendor lock-ins are also an important factor to consider because, as big pharmaceutical companies platformize AI, dependency risk grows. Granted, this is somewhat addressed by the collaborative efforts, but still, the risk remains.

Finally, AI is not a magic shield – biology is still biology, and we need to realise that not every AI-designed drug is going to succeed. Unfortunately, there are billions of combinations of various factors that need to be taken into account, and while artificial intelligence can simplify this process, it’s not going to have 100% effectiveness.

Conclusion

AI in drug development is no longer future talk—it’s here, it’s regulated, and it’s delivering real clinical candidates. By 2030, we’ll look back on this period as the moment when drug discovery became AI-native.

We said it in the beginning, and we’ll repeat it again. The message is simple: AI won’t replace discovery teams. But discovery teams using AI will outpace those who don’t.

Meanwhile, HUSPI has experience with FHIR, HL7, and AI – so in case you want to start developing the foundation for future healthcare products, we can help.

Wondering about time-to-value?

Request a no-obligation discovery call and receive a preliminary estimate tailored to your KPIs.